Japan is world-renowned for its trains, from the lightning-fast Shinkansen to quirky themed trains. If you want the most luxurious way to see Japan, step aboard one of its exclusive luxury rail tours.

These trains are not just transportation. They are rolling boutique hotels, combining elegant suites, gourmet cuisine, curated excursions, and breathtaking scenery. Before you book, you will want to know: how much does a Japan luxury rail tour cost, what is included, and how can you secure a ticket?

This guide covers everything you need, from the three main luxury trains to what drives the price, how to book, and even budget-friendly alternatives.

Japan’s Big Three Luxury Trains

1. Seven Stars in Kyushu (JR Kyushu)

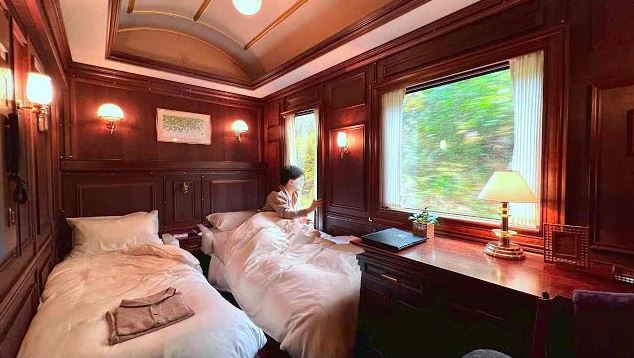

Often called the pioneer of Japan’s luxury trains, Seven Stars in Kyushu debuted in 2013. With just 14 suites, it offers an intimate experience filled with warm wooden interiors, traditional crafts, and Kyushu hospitality.

-

Routes:

-

2-day and 1-night course around northern Kyushu

-

4-day and 3-night course, a longer grand tour around the island

-

-

Cost:

-

Around 630,000 yen per person for the 2-day trip

-

Deluxe rooms on longer routes can reach 3,800,000 yen or more per room

-

-

What is included: Gourmet dining, guided excursions to hot springs and craft towns, live local performances, and in some cases, hotel stays off the train

-

Special features: Handmade interior design with wood and traditional crafts, a lounge car with live music, and curated cultural programs at stops

2. Train Suite Shiki-Shima (JR East)

The Shiki-Shima is sleek, modern, and futuristic with floor-to-ceiling glass, art-gallery interiors, and spacious suites. It departs from Tokyo and explores the northern regions.

-

Routes:

-

2-day itineraries into the Tohoku region

-

3- or 4-day itineraries extending into Hokkaido

-

-

Cost:

-

Around 440,000 to 940,000 yen per person depending on cabin type and route

-

Packages including hotel stays at Tokyo Station Hotel and transfers are priced at 1.6 to 1.9 million yen for two people

-

-

What is included: Luxury cabins, seasonal gourmet dining onboard, guided tours, cultural experiences, and sometimes hotel nights before or after the train journey

-

Special features: Observatory cars with panoramic glass, interiors inspired by both Japanese tradition and modern design, and menus created by Michelin-starred chefs

3. Twilight Express Mizukaze (JR West)

The Mizukaze, meaning fresh wind, evokes the romance of the classic Twilight Express sleeper. With art deco-inspired design, large glass windows, and observation decks, it is one of the most visually striking trains in Japan.

-

Routes:

-

2- to 3-day trips along the San’in and Sanyo coasts, often starting in Kyoto or Osaka

-

Excursions include UNESCO World Heritage sites, historic towns, and scenic coastal viewpoints

-

-

Cost:

-

Standard cabins: around 1 to 2.7 million yen per cabin for two people

-

English-language departures marketed internationally have been listed at around 9,850 euros per person

-

-

What is included: All meals including kaiseki and French-inspired fine dining, off-train excursions with guides on special departures, and luxury cabin accommodations

-

Special features: Large observation cars at both ends, a lavish dining car, and a mix of Western and Japanese-style suites

What is Included and What is Not

Included in the fare:

-

Accommodation in luxury suites

-

Multi-course gourmet meals

-

Guided sightseeing excursions

-

Selected transfers such as Shinkansen or hotel stays in some packages

-

Taxes and onboard services

Not usually included:

-

International flights

-

Pre- or post-train hotels unless part of a package

-

Personal expenses such as souvenirs or drinks outside set menus

-

Optional excursions not in the standard program

Why Luxury Trains in Japan Are Expensive

-

Very limited passenger capacity, usually only 20 to 30 guests

-

Custom-built interiors with fine wood, textiles, and art

-

High staff-to-guest ratio including chefs, attendants, and guides

-

All-inclusive nature of the journey with excursions and performances

-

High demand, with most departures selling out months in advance and some using lotteries

How to Book a Luxury Train in Japan

-

Directly with the operator

-

JR Kyushu for Seven Stars, JR East for Shiki-Shima, and JR West for Mizukaze each have official booking channels

-

Some departures require a lottery application

-

-

Through specialist tour operators

-

Many agencies abroad package the train with hotels, transfers, and flights

-

Easier for international travelers but usually more expensive

-

-

Booking tips

-

Reserve at least 6 to 12 months in advance

-

English-language departures are rare and cost more

-

Check cancellation rules as many require prepayment and have strict policies

-

Alternatives for Smaller Budgets

Luxury trains are unforgettable, but if spending over half a million yen is out of reach, there are options:

-

Gran Class or Green Car on Shinkansen: First-class seats with meal service and quiet comfort

-

Scenic day trains: JR Kyushu’s Yufuin no Mori, JR East’s Resort Shirakami, or themed trains like Aso Boy and Pokemon With You

-

Luxury ryokan combined with regular trains: Pair a scenic ride with a night at a high-end inn for a similar indulgent experience

Tips for First-Timers

-

Choose the train that matches your style: traditional Seven Stars, futuristic Shiki-Shima, or romantic Mizukaze

-

Be flexible with travel dates since departures are limited

-

Budget realistically and include flights and hotels before and after the train journey

-

Check language options since most staff are Japanese-speaking, with some English-speaking departures available

-

Think of it as a rail cruise with slow immersive travel and curated stops

Conclusion:

Luxury trains in Japan are not about speed or efficiency. They are about slowing down, savoring gourmet meals, meeting locals, and enjoying landscapes through panoramic windows while relaxing in a private suite.

They are expensive, often costing as much as a week in a luxury resort. But for train enthusiasts, honeymooners, or anyone seeking a once-in-a-lifetime journey, a luxury rail tour in Japan is unforgettable.

If the full luxury experience is beyond your budget, you can still enjoy Japan’s unique rail culture through scenic day trains or premium Shinkansen seats. Either way, traveling by train in Japan makes the journey itself part of the adventure.